3QFY2016 Result Update | Logistics

February 11, 2016

Navkar Corporation

BUY

CMP

`176

Performance Update

Target Price

`265

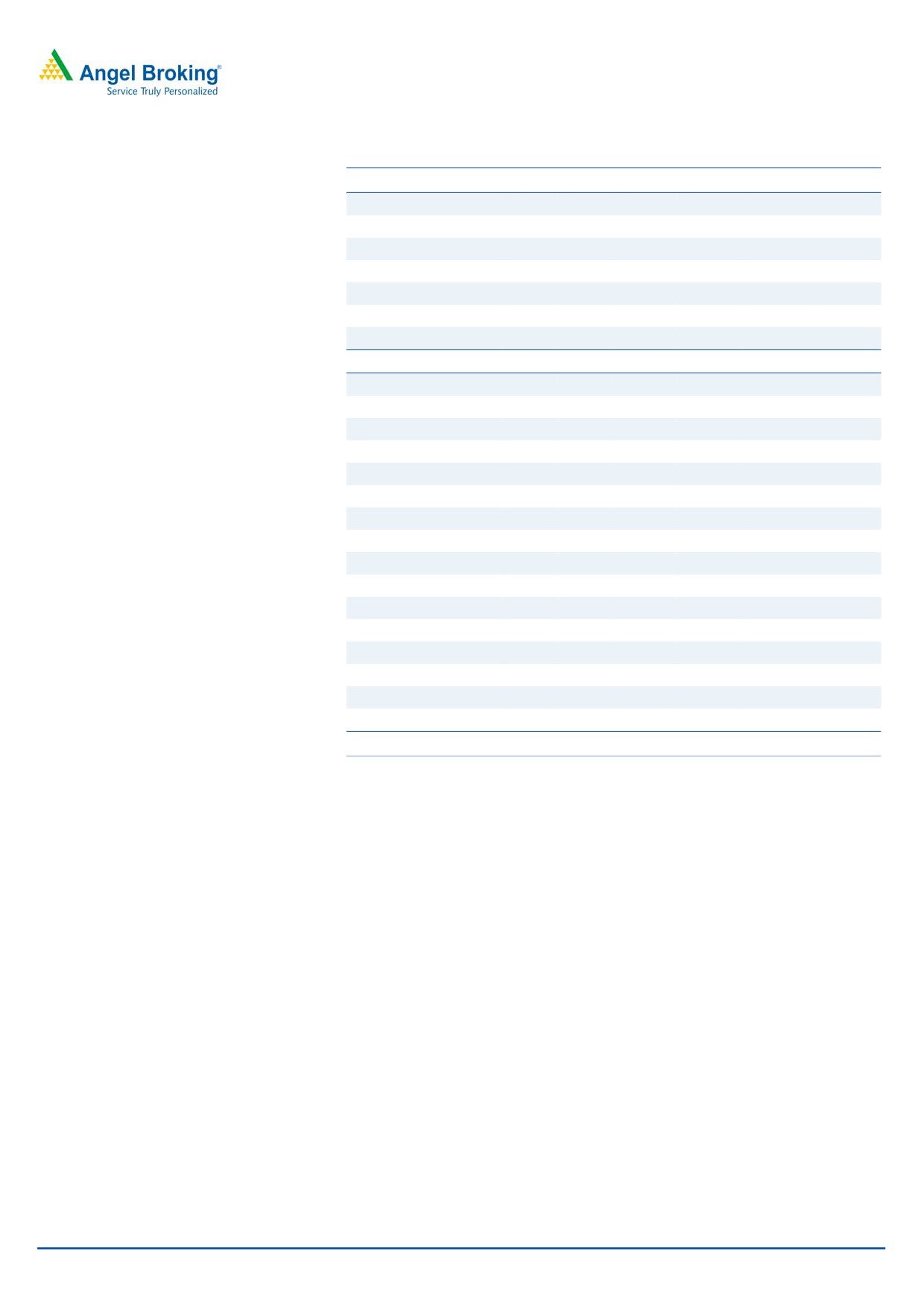

Y/E March (` cr)

3QFY2016 3QFY2015

% chg (yoy) 2QFY2016

% chg (qoq)

Investment Period

-

Net sales

88

84

4.6

86

3.1

Sector

Logistics

EBITDA

37

37

0.9

37

(0.0)

Market Cap (Rs cr)

2,460

EBITDA margin (%)

42.0

43.5

(154bp)

43.3

(130bp)

Net Debt

549

Adjusted PAT

29

16

83.0

22

33.7

Beta

0.6

Source: Company, Angel Research

52 Week High / Low

221 / 151

Avg. Daily Volume

61,027

Navkar Corporation (Navkar) reported a mixed set of numbers for 3QFY2016.

Face Value (Rs)

10

The consolidated top-line grew by ~5% yoy. On the operating front, the company

BSE Sensex

22,952

reported a margin contraction on account of higher operating and employee

Nifty

6,976

expenses. However, the net profit grew by ~83% yoy (after factoring in forex

Reuters Code

NA

losses) due to higher other income and lower interest related expenses.

Bloomberg Code

NACO@IN

Top-line grew ~5% yoy: The consolidated top-line grew by ~5% yoy to ~`88cr

owing to subdued EXIM volumes. Volume grew ~7% yoy to 80,815 TEUs, mainly

Shareholding Pattern (%)

due to a higher mix of imports. The commodity mix comprised of agro products

Promoters

72.9

(~43%), hazardous products (~14%) while other product categories accounted

for the balance ~43%.

MF / Banks / Indian Fls

15.3

PAT grew ~83% yoy despite operating margin contraction: On the operating

FII / NRIs / OCBs

6.2

front, the company reported a margin contraction of 154bp yoy to 42.0% on

Indian Public / Others

5.7

account of higher operating and employee expenses. As a result, the EBITDA

came in flat yoy at ~`37cr. However, the net profit grew by ~83% yoy to ~`29cr

Abs. (%)

3m 1yr 3yr

due to higher other income and lower interest related expenses.

Sensex

(7.7)

(16.2)

22.1

Outlook and Valuation: We estimate Navkar to post a revenue CAGR of ~26%

NCL

2.9

NA NA

and PAT CAGR of ~31% over FY2015-18E. We have factored in lower utilization

levels of 33.2% and 42.2% for FY2017E and FY2018E, respectively. At the current

levels, the stock is trading at 15.3x its FY2018E earnings. Historically, Navkar has

Historical share price chart

consistently grown at JNPT and increased its utilisation from 68% in FY2012 to

87% in FY2015 by leveraging on its rail advantage during periods when JNPT

220

210

posted flattish volume growth. Going forward, we expect Navkar’s utilizations to

200

190

improve; we expect the company to be able to garner a good chunk of business

180

over the next three to four years due to its rail advantage at both JNPT and Vapi.

170

160

We maintain our Buy recommendation on the stock with a target price of `265.

150

140

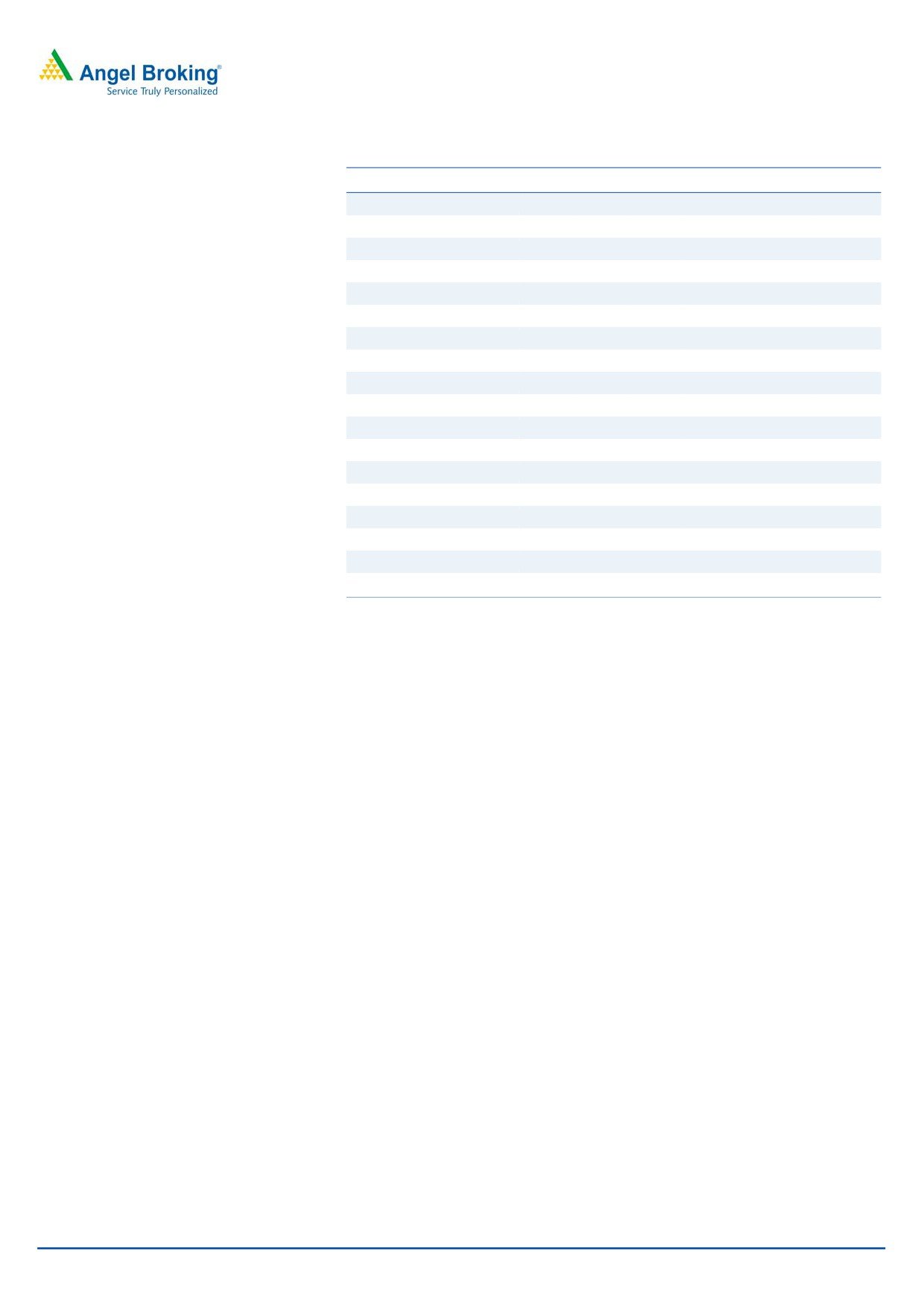

Key Financials

Y/E March (` cr)

FY2014

FY2015

FY2016E

FY2017E FY2018E

Net sales

349

329

365

436

664

Source: Company, Angel Research

% chg

4.8

(5.9)

11.2

19.3

52.2

Adj. Net profit

90

73

80

84

164

% chg

58.7

(18.7)

9.9

4.3

95.8

EBITDA margin (%)

35.5

40.7

38.3

37.5

37.5

EPS (`)

6.3

5.1

5.6

5.9

11.5

Amarjeet S Maurya

P/E (x)

27.9

34.3

31.2

29.9

15.3

022-40003600 Ext: 6831

P/BV (x)

5.9

3.3

2.0

1.8

1.6

RoE (%)

21.0

9.7

6.3

6.1

10.7

RoCE (%)

12.8

9.1

6.7

7.5

11.4

Milan Desai

EV/Sales (x)

8.4

9.3

7.7

6.6

4.3

022-40003600 Ext: 6846

EV/EBITDA (x)

23.6

22.8

20.1

17.6

11.4

Source: Company, Angel Research Note: CMP as of February 11, 2016

Please refer to important disclosures at the end of this report

1

Navkar Corporation | 3QFY2016 Result Update

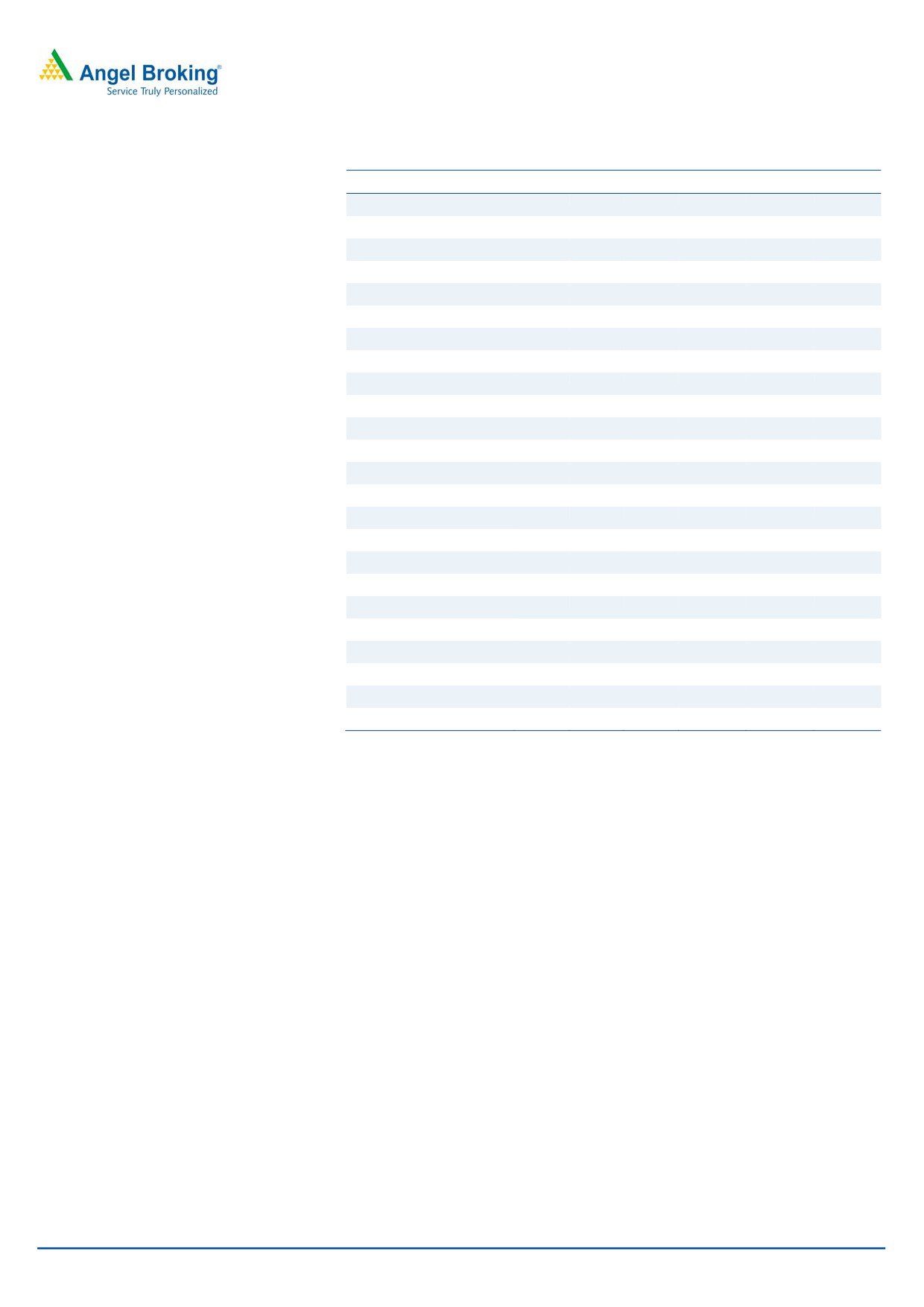

Exhibit 1: 3QFY2016 performance

Y/E March (` cr)

3QFY16

3QFY15

% chg. (yoy)

2QFY16

% chg. (qoq)

9MFY16

9MFY15

% chg

Net Sales

88

84

4.6

86

3.1

256

245

4.6

Operating Expenses

36

33

10.9

35

4.3

105

101

3.2

(% of Sales)

41.0

38.7

40.5

40.9

41.5

Employee Cost

7

5

33.1

6

12.8

18

16

17.7

(% of Sales)

7.8

6.1

7.1

7.2

6.4

Other Expenses

8

10

(17.3)

8

4.5

21

21

(1.2)

(% of Sales)

9.2

11.7

9.1

8.3

8.7

Total Expenditure

51

48

7.5

49

5.4

144

138

4.1

Operating Profit

37

37

0.9

37

(0.0)

112

106

5

OPM (%)

42.0

43.5

(154)

43.3

(130)

43.7

43.4

27

Interest

7

17

(55.8)

12

(39.0)

33

37

(11.6)

Depreciation

5

4

30.4

5

0.1

15

11

28.8

Other Income

10

1

1,858.8

4

142.1

17

2

905.2

PBT

35

17

106.1

24

43.3

81

60

36.3

(% of Sales)

39.5

20.0

28.4

31.7

24.3

Tax

6

1

417.5

3

118.7

12

4

235.3

(% of PBT)

17.3

6.9

11.3

14.6

5.9

Reported PAT

29

16

83.0

22

33.7

69

56

23.8

Extraordinary Expense/(Inc.)

-

-

-

-

-

Adjusted PAT

29

16

83.0

22

33.7

69

56

23.8

PATM

32.6

18.7

25.2

27.1

22.9

Source: Company, Angel Research

February 11, 2016

2

Navkar Corporation | 3QFY2016 Result Update

Investment Arguments

Upcoming ICD to provide an edge

The Vapi region has a huge market potential as it is a well developed industrial

area. As per the Management and industry sources, the Vapi region accounts for

close to 27% of container volumes at JNPT. We believe that ICD (with rail

connectivity) will enable Navkar to garner a good portion of the business from the

region. At present, imports headed for the region have to get custom cleared at

CFS/ICD at JNPT and are then transported via road. With rail transport being a

more economical option compared to road, the imports should head directly to Vapi

ICD. As for exports from Vapi region, a large portion (~60%) is stuffed at factory and

transported to JNPT. However, the balance 40% or ~170,000 TEUs (less-than-

container load [LCL]) which is being transported via road and consolidated at JNPT,

can be consolidated at the ICD. Once the scale advantages kick in, and given the rail

advantage, the company can also cater to some portion of bulkier factory stuffed

cargo.

Capacity enhancement at Somathane to aid revenue growth

The company has managed to outgrow its peers in the region by attracting

volumes on the back of its rail advantage. Navkar has been facing capacity

constraints at JNPT and is forced to reject certain bulk commodities like PTA, Fiber,

Scrap, Marble, etc. Although the current South Gujarat volume of Navkar

(~70,000 TEUs) is expected to shift to the Vapi ICD, the company will now be able

to handle these bulk commodities and effectively utilize its extended capacity.

Navkar will now also be handling domestic traffic, which it had been rejecting

earlier, thus aiding growth.

Logistics park at Vapi to be an additional revenue driver

The logistics park will be a one-stop solution for importers and exporters, providing

a host of warehousing and other value added services. Its close proximity to one of

the largest industrial clusters in India augurs well for Navkar.

February 11, 2016

3

Navkar Corporation | 3QFY2016 Result Update

Outlook and Valuation

We estimate Navkar to post a revenue CAGR of ~26% and PAT CAGR of ~31%

over FY2015-18E. We have factored in lower utilization levels of 33.2% and 42.2%

for FY2017E and FY2018E, respectively. At the current levels, the stock is trading

at 15.3x its FY2018E earnings. Historically, Navkar has consistently grown at JNPT

and increased its utilisation from 68% in FY2012 to 87% in FY2015 by leveraging

on its rail advantage during periods when JNPT posted flattish volume growth.

Going forward, we expect Navkar’s utilizations to improve; we expect the company

to be able to garner a good chunk of business over the next three to four years

due to its rail advantage at both JNPT and Vapi. We maintain our Buy

recommendation on the stock with a target price of `265.

Downside risks to our estimates include

The company is exposed to currency risk with foreign currency debt of `194cr

on its balance sheet (as of 31-03-2015). The company uses dollar call options

to hedge against dollar appreciation and as per the term, the foreign currency

debt will get converted to INR debt upon dollar rate hitting the strike price. In

this event, the interest rate on the INR debt will be at ~12%.

Currently the company is paying lower taxes, with it getting tax benefits for its

CFS operations. Once the exemption period is over, the company will have to

pay higher taxes, which could impact its earnings growth.

Delay in capacity expansion and lower than expected utilization of existing

CFS as well as existing players increasing their capacity at JNPT could impact

the profitability of the company. Delay in capacity enhancement at JNPT can

also impact the top-line.

The company operates a PFT at JNPT which has helped the company in

increasing its volumes. Lapse in agreement with the Indian Railways will lead

to the company being unable to operate its PFT.

February 11, 2016

4

Navkar Corporation | 3QFY2016 Result Update

Company Background

Navkar is a CFS operator with three CFSs, Ajivali CFS I and Ajivali CFS II at Ajivali

and one at Somathane. All of its CFS units are strategically located in close

proximity to JNPT which is the largest container port in India. As of May 31, 2015,

Navkar’s CFSs had an aggregate installed handling capacity of 310,000 TEUs per

annum. It has a PFT which facilitates loading and unloading of cargo from

container trains operating between Somathane CFS and JNPT and to transport

domestic cargo to and from inland destinations on the Indian rail network. As of

May 31, 2015, it also owns and operates 516 trailers for the transportation of

cargo between its CFSs and the JN Port by road. The company offers services like

cargo storage facilities at CFSs, packing, labeling/bar-coding, palletizing,

fumigation and other related activities. It also provides warehousing facilities, for

which, it occupies an aggregate area of 500,000 sq ft.

Exhibit 2: CFS details

Particulars

Ajivali CFS I

Ajivali CFS II

Somathane CFS

Somathane/Ashte

Location

Ajivali village, Panvel Ajivali village, Panvel

village, Panvel

Area Custom Notified

135,156 sq. ft.

428,400 sq. ft.

1,073,224.35 sq. ft.

Operational since

May 12, 2008

May 18, 2006

May 11, 2009

Installed Capacity per

25,000 TEUs

65,000 TEUs

220,000 TEUs

annum

Bonded warehouse

-

27,641 sq. feet

33,141 sq. feet

Reefer Points

16

24

52

Temperature controlled

-

500 m

-

chambers

Authorized to handle,

Authorized to handle,

store and deliver

store and deliver

Hazardous cargo

-

hazardous cargo up to

hazardous cargo, up

the total installed

to the total installed

capacity per annum capacity per annum

Connectivity

Road

Road

Rail and road

Source: Company, Angel Research

February 11, 2016

5

Navkar Corporation | 3QFY2016 Result Update

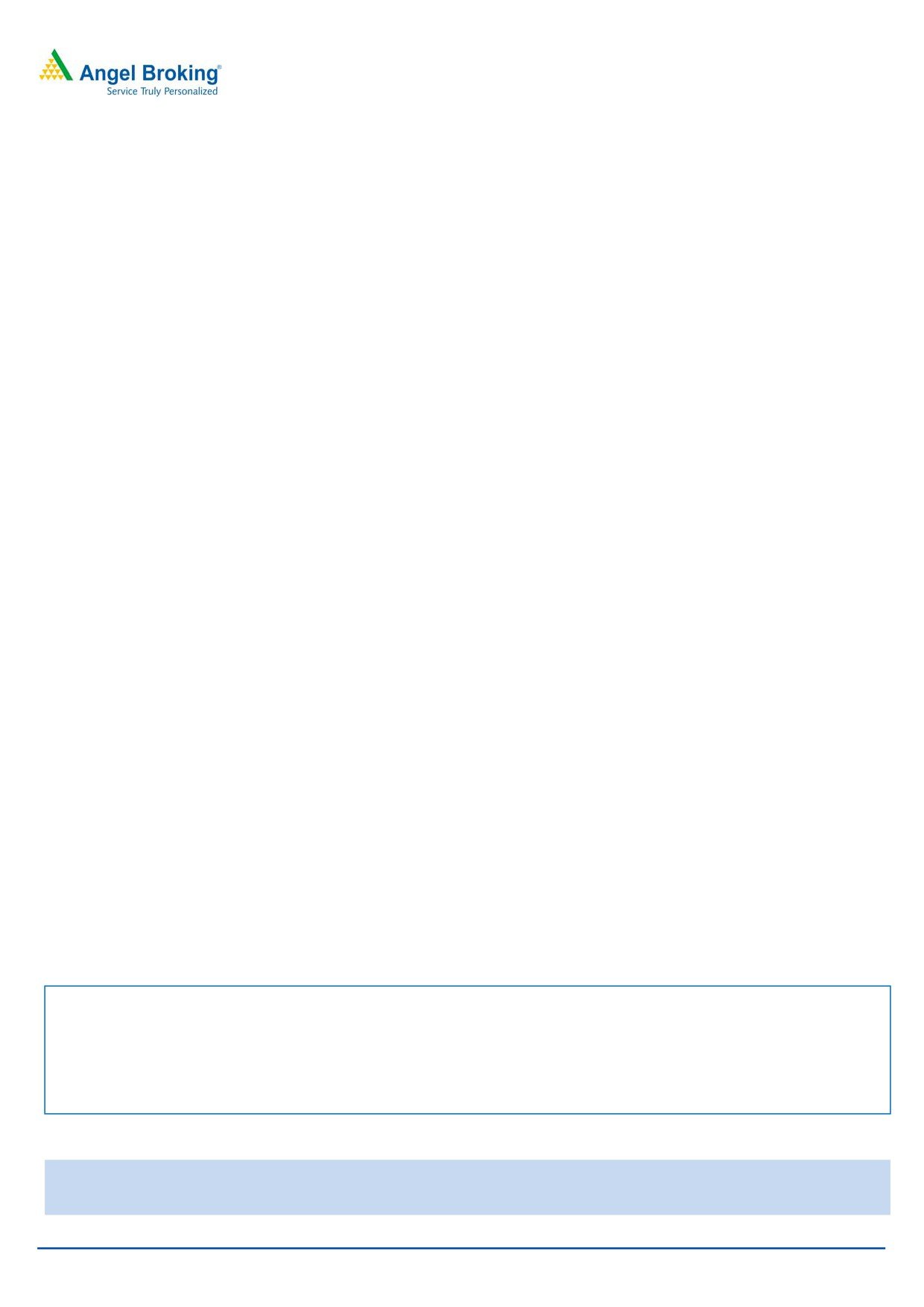

Consolidated Profit & Loss Statement

Y/E March (` cr)

FY13

FY14

FY15

FY16E

FY17E

FY18E

Total operating income

333

349

329

365

436

664

% chg

24.4

4.8

(5.9)

11.2

19.3

52.2

Total Expenditure

232

225

195

225

273

415

Operating Expenses

92

117

138

157

188

289

Purchases of Traded Goods

105

60

-

-

-

-

Personnel Expenses

17

19

22

26

34

53

Others Expenses

18

29

34

42

50

73

EBITDA

102

124

134

140

164

249

% chg

12.9

21.9

7.9

4.5

16.8

52.2

(% of Net Sales)

30.5

35.5

40.7

38.3

37.5

37.5

Depreciation& Amortisation

10

13

15

22

28

30

EBIT

92

111

119

118

135

219

% chg

11.5

21.3

6.9

(0.3)

14.4

61.7

(% of Net Sales)

27.5

31.8

36.1

32.4

31.0

33.0

Interest & other Charges

32

33

26

41

47

42

Other Income

5

4

2

10

3

3

(% of PBT)

7.3

4.7

2.3

11.4

3.3

1.7

Share in profit of Associates

-

-

-

-

-

-

Recurring PBT

64

82

94

87

92

180

% chg

21.3

28.4

15.4

(7.5)

4.8

96.9

Prior Period & Extraord. Exp./(Inc.)

-

-

-

-

-

-

PBT (reported)

64

82

94

87

92

180

Tax

7

9

7

7

8

16

(% of PBT)

11.1

10.8

7.4

8.0

8.5

9.0

PAT (reported)

57

73

87

80

84

164

Extraordinary Items

0

17

(14)

-

-

-

ADJ. PAT

57

90

73

80

84

164

% chg

58.7

(18.7)

9.9

4.3

95.8

(% of Net Sales)

17.0

25.8

22.2

22.0

19.2

24.7

Basic EPS (`)

4.0

6.3

5.1

5.6

5.9

11.5

Fully Diluted EPS (`)

4.0

6.3

5.1

5.6

5.9

11.5

% chg

20.8

58.7

(18.7)

9.9

4.3

95.8

February 11, 2016

6

Navkar Corporation | 3QFY2016 Result Update

Consolidated Balance Sheet

Y/E March (` cr)

FY13

FY14

FY15

FY16E

FY17E

FY18E

SOURCES OF FUNDS

Equity Share Capital

17

21

112

145

145

145

Reserves& Surplus

299

407

638

1,139

1,222

1,387

Shareholders’ Funds

316

428

750

1,283

1,367

1,531

Minority Interest

-

-

-

-

-

-

Total Loans

444

437

555

495

440

390

Deferred Tax Liability

21

28

33

33

33

33

Total Liabilities

781

893

1,338

1,812

1,840

1,954

APPLICATION OF FUNDS

Gross Block

651

699

1,133

1,409

1,556

1,606

Less: Acc. Depreciation

30

43

59

81

109

139

Net Block

620

656

1,073

1,328

1,447

1,467

Capital Work-in-Progress

0

44

27

27

27

27

Investments

20

20

5

5

5

5

Current Assets

156

198

253

473

385

497

Inventories

-

-

2

2

2

4

Sundry Debtors

63

76

77

87

104

158

Cash

4

1

1

191

61

56

Loans & Advances

42

45

48

55

65

100

Other Assets

47

76

126

139

153

179

Current liabilities

16

25

22

23

26

43

Net Current Assets

140

172

231

450

360

454

Deferred Tax Asset

0

1

1

1

1

1

Mis. Exp. not written off

-

-

-

-

-

-

Total Assets

781

893

1,338

1,812

1,840

1,954

February 11, 2016

7

Navkar Corporation | 3QFY2016 Result Update

Consolidated Cashflow Statement

Y/E March (` cr)

FY13

FY14

FY15

FY16E

FY17E

FY18E

Profit before tax

64

99

80

87

92

180

Depreciation

10

13

15

22

28

30

Change in Working Capital

(19)

(29)

7

(29)

(39)

(99)

Interest / Dividend (Net)

32

33

26

41

47

42

Direct taxes paid

(15)

(16)

(22)

(7)

(8)

(16)

Others

0

(17)

18

-

-

-

Cash Flow from Operations

73

82

123

114

120

136

(Inc.)/ Dec. in Fixed Assets

(89)

(93)

(209)

(276)

(147)

(50)

(Inc.)/ Dec. in Investments

(20)

-

15

-

-

-

Cash Flow from Investing

(109)

(93)

(194)

(276)

(147)

(50)

Issue of Equity

43

35

-

453

-

-

Inc./(Dec.) in loans

27

10

97

(60)

(55)

(50)

Dividend Paid (Incl. Tax)

-

-

-

-

-

-

Interest / Dividend (Net)

11

1

(27)

412

(47)

(42)

Cash Flow from Financing

38

10

71

352

(102)

(92)

Inc./(Dec.) in Cash

1

(1)

0

189

(129)

(5)

Opening Cash balances

0

2

1

1

191

61

Closing Cash balances

2

1

1

191

61

56

February 11, 2016

8

Navkar Corporation | 3QFY2016 Result Update

Key Ratios

Y/E March

FY13

FY14

FY15

FY16E

FY17E

FY18E

Valuation Ratio (x)

P/E (on FDEPS)

44.3

27.9

34.3

31.2

29.9

15.3

P/CEPS

37.5

29.2

24.5

24.6

22.4

12.9

P/BV

7.9

5.9

3.3

2.0

1.8

1.6

Dividend yield (%)

0.0

0.0

0.0

0.0

0.0

0.0

EV/Sales

8.8

8.4

9.3

7.7

6.6

4.3

EV/EBITDA

28.8

23.6

22.8

20.1

17.6

11.4

EV / Total Assets

3.7

3.2

2.2

1.5

1.5

1.4

Per Share Data (`)

EPS (Basic)

4.0

6.3

5.1

5.6

5.9

11.5

EPS (fully diluted)

4.0

6.3

5.1

5.6

5.9

11.5

Cash EPS

4.7

6.0

7.2

7.2

7.9

13.6

DPS

0.0

0.0

0.0

0.0

0.0

0.0

Book Value

22.2

30.0

52.6

90.0

95.9

107.4

Returns (%)

ROCE

12.0

12.8

9.1

6.7

7.5

11.4

Angel ROIC (Pre-tax)

12.5

13.2

9.1

7.5

7.8

11.8

ROE

17.9

21.0

9.7

6.3

6.1

10.7

Turnover ratios (x)

Asset Turnover (Gross Block)

0.5

0.5

0.3

0.3

0.3

0.4

Inventory / Sales (days)

-

-

2

2

2

2

Receivables (days)

69

80

86

87

87

87

Payables (days)

5

7

7

5

4

4

Wc cycle (ex-cash) (days)

64

72

81

84

85

85

February 11, 2016

9

Navkar Corporation | 3QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavours to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking

or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or

in the past.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Navkar Corporation

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

Reduce (-5% to -15%)

Sell (< -15%)

February 11, 2016

10